by Mary Lou Masters

The collapse of Silicon Valley Bank (SVB) has sparked comments from 2024 GOP candidates and hopefuls about why the bank failed and what the government should do in its wake.

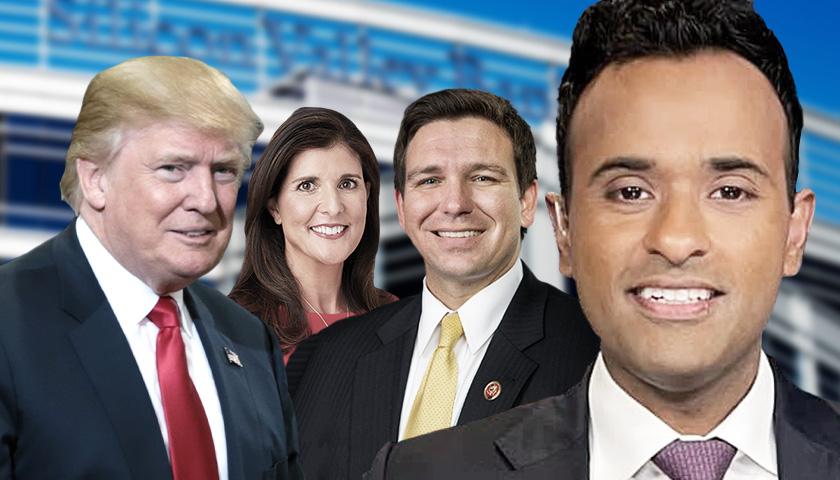

Declared candidates, businessman Vivek Ramaswamy, former South Carolina Gov. Nikki Haley and former President Donald Trump, as well as contender Florida Gov. Ron DeSantis, have spoken out about what might have led to SVB’s collapse and against government bailouts. The Federal Deposit Insurance Corporation (FDIC) took control of SVB after its Friday shut down when their stock plummeted following mass withdrawals.

“Silicon Valley is pushing the idea that SVB depositors need to be rescued to prevent a run on other banks. Wrong. If you want to prevent a run on other banks, increase the FDIC guarantee. But SVB screwed up by utterly failing to take interest rate risk into account, in two ways – both in terms of client concentration risk amongst startups and investing in interest rate-sensitive securities. So did the many startups who blithely did business with them. It’s not the U.S. taxpayer’s job to now coddle them,” Ramaswamy said.

The conservative businessman also criticized SVB for investing too much into diversity, equity and inclusion (DEI) and environment, social and governance (ESG) initiatives when they didn’t have enough to ensure deposits, according to Breitbart. Almost 90 percent of depositors at SVB are uninsured.

The conservative businessman also criticized SVB for investing too much into diversity, equity and inclusion (DEI) and environment, social and governance (ESG) initiatives when they didn’t have enough to ensure deposits, according to Breitbart. Almost 90 percent of depositors at SVB are uninsured.

For comic relief, here’s a list of “cross-function working groups” from SVB’s 2022 ESG report:

– Sustainable Finance Group: Develops strategy and monitors progress against SVB’s Climate Commitment

• Investments Group: Reviews updates from our businesses on sustainability and…— Vivek Ramaswamy (@VivekGRamaswamy) March 12, 2023

Just over a year ago, SVB announced investing $5 billion into sustainability efforts like “technology solutions that mitigate greenhouse gas emissions” and “climate resilience.”

Ramaswamy is against government bailouts, and instead wants the FDIC to move out of the way and allow other banks to acquire SVB. He also suggested the FDIC raise their guarantee from $250,000 to $10 million.

“Taxpayers should absolutely not bail out Silicon Valley Bank. Private investors can purchase the bank and its assets. It is not the responsibility of the American taxpayer to step in. The era of big government and corporate bailouts must end,” Haley said in a statement.

Trump believes President Joe Biden‘s economy is to blame and said his tax increases are the “largest and dumbest” in history “times five.”

“WE WILL HAVE A GREAT DEPRESSION FAR BIGGER AND MORE POWERFUL THAN THAT OF 1929. AS PROOF, THE BANKS ARE ALREADY STARTING TO COLLAPSE!!!” Trump said on Truth Social.

DeSantis noted that the federal bureaucracies didn’t do anything to prevent the bank’s closure, which he said was “disappointing.”

“This bank, they’re so concerned with DEI and politics and all kinds of stuff. I think that really diverted from them focusing on their core mission,” DeSantis told Fox News on Sunday.

The FDIC transferred all of SVB’s insured deposits to the Deposit Insurance National Bank of Santa Clara (DINB), and the DINB will resume SVB’s banking activities Monday.

– – –

Mary Lou Masters is a reporter at Daily Caller News Foundation.

Photo “Vivek Ramaswamy” by Vivek Ramaswamy. Photo “Donald Trump” by Gage Skidmore. CC BY-SA 2.0. Photo “Ron DeSantis” by Federal Government of the United States. Photo “Nikki Haley” by Nikki Haley. Background Photo “Silicon Valley Bank” by Tony Webster. CC BY 2.0.